Estimated reading time: 3 minutes

In high school, many of us start thinking about what future career we will have. Once we choose, chances are, it pays a woman less than a man– for the same work. But, since I still want to pursue a career, I go ahead and plan to take an education loan out for my studies, thinking I should be able to pay it off once I get a job. Except, women hold about two-thirds of student loan debt. We have to pay extra for many of our necessities; our employment is more at risk; there are higher chances of unequal inheritance; we’re rarely taught how to handle our financial accounts; and how could I possibly forget the pink tax, which makes women pay extra for the items they buy simply because they are marketed specifically towards women!

All of this makes me sit and wonder just how much I, as a woman, even control my economic and financial life.

Currently, a billion women are financially excluded from financial services–and education about finance–and only 38% are considered financially independent. Since the global outbreak of the COVID-19 pandemic, 47 million women have been pushed into extreme poverty.

Most gender-based financial barriers are still unheard of or not widely spoken about, and it’s difficult to dismantle something we don’t know exists. Therefore, we need to understand the economic barriers women face in order to break them down. Here are just a few:

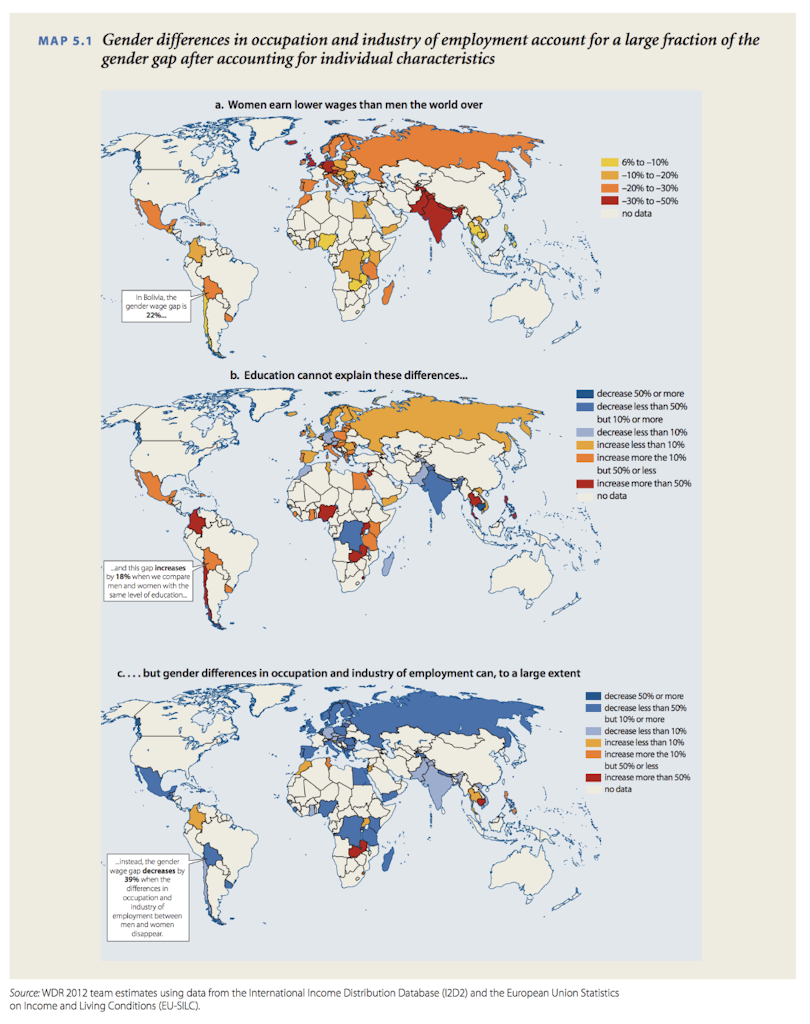

- Gender pay gap: The pay gap is a measure of the difference women are paid relative to men for the same work. In a myriad of countries, pay discrimination based on gender is illegal but nevertheless, it still occurs. The pay gap varies by a number of factors such as race, occupation, and location but, on average, women earn 20% less than men. It is estimated that equal pay would boost women’s earning by $2 trillion in developing countries.

- Pink tax: In July 2022, I gave a speech at the Girl Up Global Leadership Summit and worked on a data science project on this very topic. In my opinion, the pink tax is not actually a tax but rather a clever scheme that makes women pay more for many goods just for being a woman. Although it seems as if it’s a small additional amount to the product price, the accumulated extra fees end up being a large sum that only women are paying.

- Lack of information: Women are often not taught the basics of financial independence because of social and cultural norms. Due to this stigma, there are a number of women who are financially dependent on men, are targets of theft or fraud, or face large amounts of debt.

Now that we know the problems, what are the solutions? The first step is to make our communities more aware of these issues and to educate ourselves and others about financial literacy. We must also prioritize teaching basic financial documentation & procedures to women, especially at the grassroots level.

The technology that gives us the world at our fingertips is also one of the best solutions to this grave problem. Did you know that women are less likely to own a phone? And that something as simple as a SIM card can allow a person to open a bank account? Digital financial platforms can not only increase accessibility to a number of fin-tech services, but can also provide women more access to the knowledge to become financially independent.

It doesn’t matter who or where you are– a 15-year-old student in the USA, a 27-year-old manager in France, a 50-year-old farmer in India– the economic empowerment of women empowers the world’s economy as a whole. Together, we must work on this problem that has been overlooked for decades and be the generation of women who proudly say, “Mom, I am a rich man.”